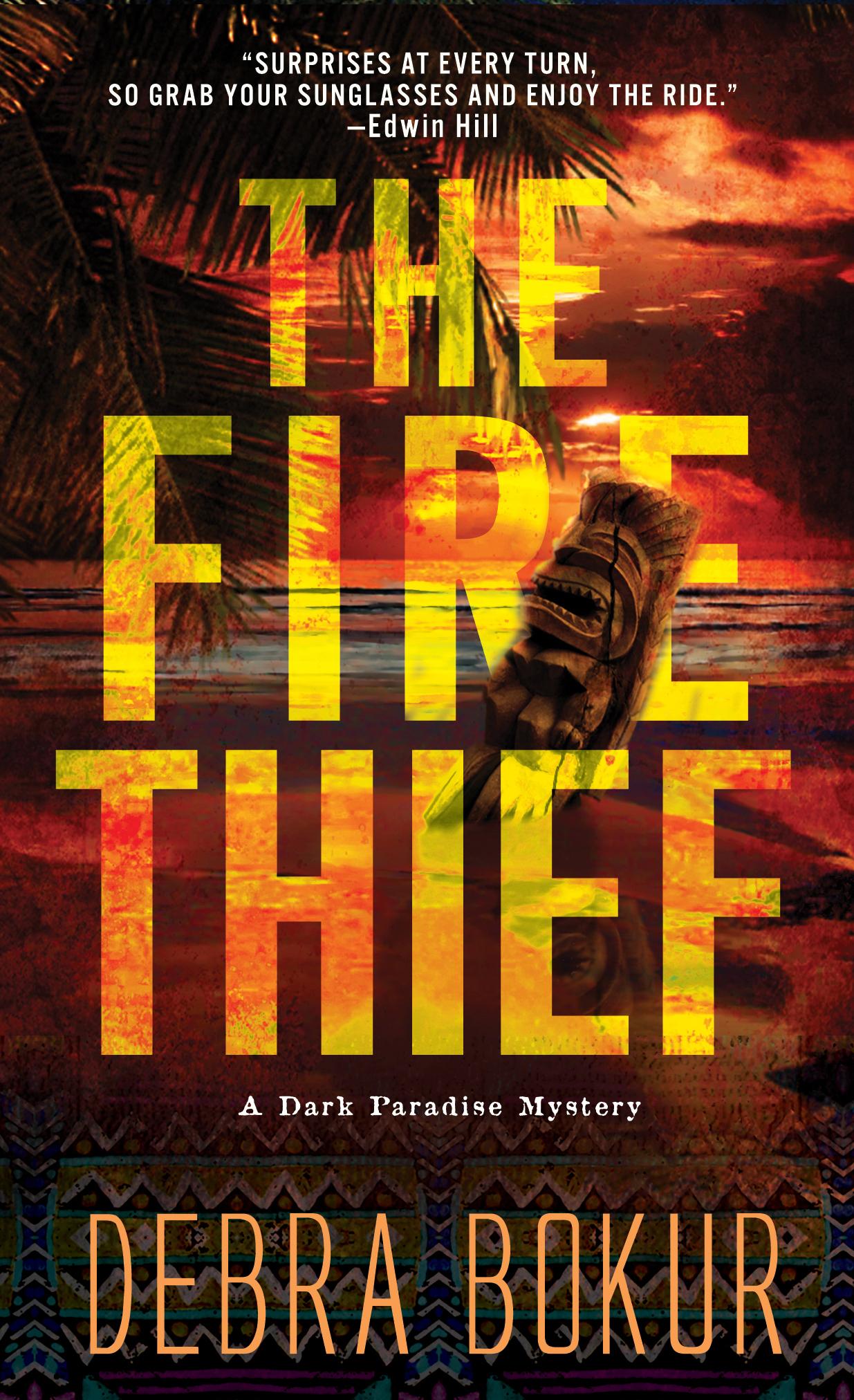

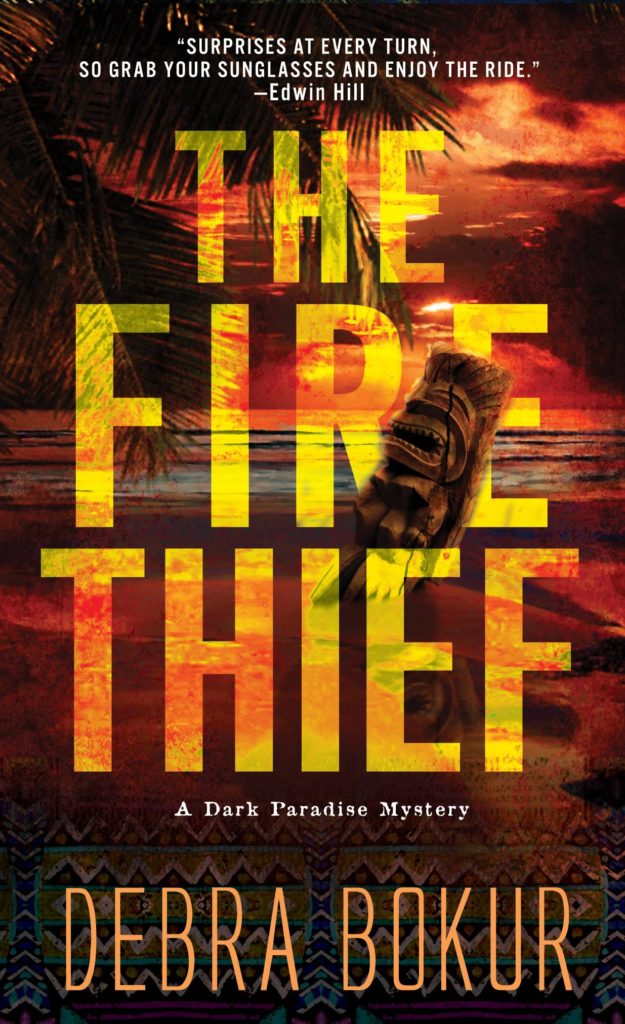

The first book in Debra Bokur’s mystery series, The Fire Thief, was released last month to rave reviews. The series is set in Hawaii and you can check it out on her website at https://www.debrabokur.com/.

Debra visited with me on The Writer’s Voice this week, and we talked about how her career as a celebrated journalist and editor of magazines and literary journals did NOT prepare her for writing and publishing fiction. You can listen to the podcast episode here. A short video excerpt will appear on my YouTube channel on Friday, here.

As most writers will agree, we tend to write long or short. When you’re a journalist, as Debra is, you tend to write to specific word counts required by the outlet publishing your work, such as 1,000 per piece. When you write fiction, you tend to write thousands and thousands of words … only to find you need to slash your word count by as much as 25%.

My experiences have been different from Debra’s. I found that writing a newspaper column and magazine articles actually helped me keep my fiction writing tight and in accordance with required word counts. Then again, I began writing fiction first and found it fairly easy to cut word count. Not every writer can toss away words with relish.

But when you begin writing short nonfiction it’s much more difficult to retrain yourself. Give Debra’s interview a listen and then share YOUR take on how writing one particular type of work did or did not prepare you for tackling another type.